A pragmatic approach towards consolidation in the semi Industry

Consolidation is not a new phenomenon for the semiconductor Industry. Although the industry has shown no consolidation through almost all of its history and 30 to 40 years, semiconductor companies enjoyed a huge compound annual growth rate. Last year, this changed as the CAGR declined tremendously and we saw a wave of consolidation activity.

Because of the rapid innovation that has occurred in the semiconductor industry over many decades, the need to boost growth saw a wave of consolidation hit the semiconductor industry in the past few years when multiple acquisitions took place.

The idea behind the acquisition was to eliminate redundant functions to optimize operational inefficiencies. The more volume and revenue a company has, the more convincing it is as a leader across multiple connected technologies. In addition to this, companies also mentioned that merging would help them develop products for data center markets and for the ‘Internet of Things,’ a model that gives everyday objects internet connectivity and allows them to send and receive data.

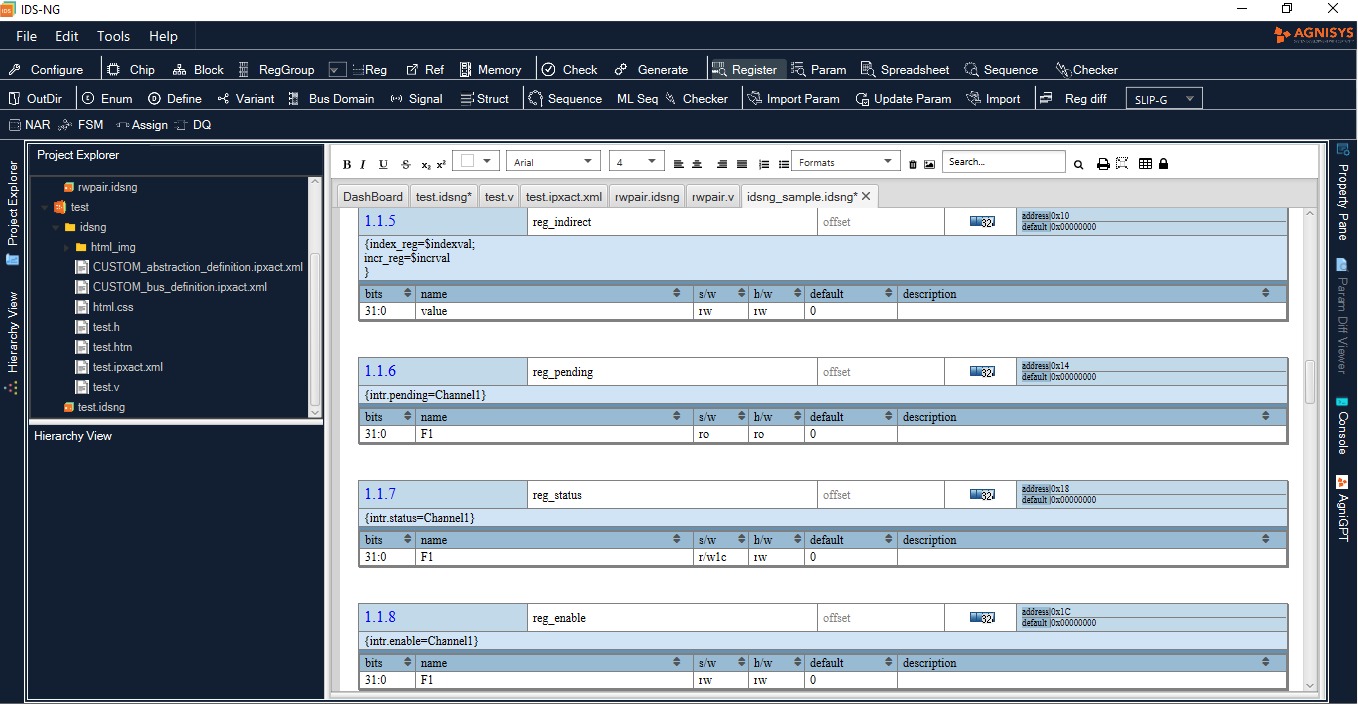

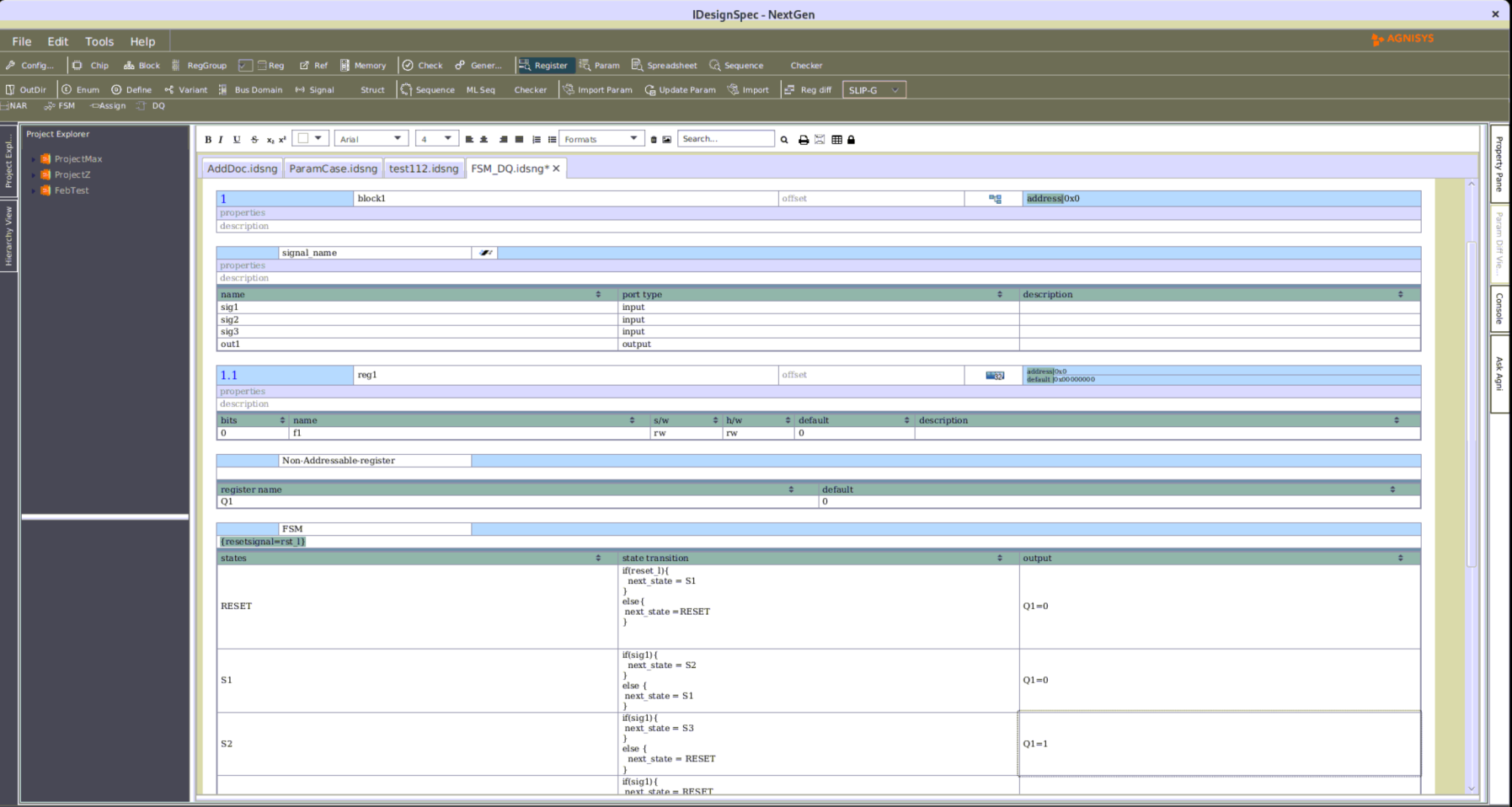

These multiple consolidations in the semiconductor industry will probably help make designs better and less expensive. Machine learning is starting to have an impact on the EDA tools business, cutting the cost of designs by allowing tools to suggest solutions to common problems that would take design teams weeks or even months to work through.

Qualcomm Inc. said its $39 billion acquisition of NXP Semiconductors NV is on schedule to close by the end of the year, paving the way for it to be a major player in autonomous driving. Rising costs and the difficulty of shrinking features are changing the dynamics of who buys IP, tools, and chips in the Semiconductor Industry.

The semiconductor market was on a roll this year (2017). According to the World Semiconductor Trade Statistics, global semiconductor revenue grew 11.5% this year to $378 billion, a remarkable upgrade over the initial growth forecast of just 3%. The EDA business this year reported double-digit growth in Q1, led by gains in the two largest categories, CAE and Semiconductor IP. Industry revenue increased 10.5 percent for Q1 2017 to $2167.5 million, compared to $1962 million in Q1 2016 Industry watchers forecast a 2.7% jump in semiconductor sales next year, though actual revenue could jump further as memory pricing momentum is slated to continue in 2018.

So, is it time to declare that the new era of semiconductor consolidation has begun? More than ever companies are adopting the consolidation strategy to boost their sales in the semiconductor domain to drive high return on investment. We are certainly seeing a positive impact of this consolidation on our own EDA industry.